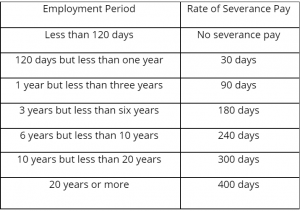

Severance Pay Due

Severance pay is a type of compensation that companies offer to employees who are being let go due to layoffs, downsizing, restructuring, or company relocation. Often, severance packages include a few weeks of pay for every year the employee has been employed at the company. In addition, severance pay often includes performance-based bonuses that were earned during the tenure of the employee.

While it is not required by law that employers provide severance pay, many do because they realize the benefits of doing so. In fact, a study conducted by talent mobility firm Randstad RiseSmart found that 64% of companies that offered severance pay in 2021 did so because they wanted to help workers who lost their jobs due to workforce transitions.

However, there are situations where severance is not paid. For example, if an employer terminates an employee without cause, there is no severance package to offer. This is not to say that an employee can’t negotiate a severance package in these circumstances, but it is usually not a given.

The timing of severance pay is determined by the terms of the contract or agreement signed by the employee and the company. Typically, the company will set forth in writing a schedule of payments and when each one is to be received. In addition, the company will likely require that the employee sign a release that stipulates they are not seeking legal action against the business should they be terminated.

When Is Severance Pay Due?

Generally, severance pay is paid within seven days after the employee is laid off or receives notice of termination. However, if the company is a federal contractor or has received notice of a federal government shutdown, the severance pay may not be payable until the last day of employment.

Severance pay is taxable in the same way as regular wages. It is generally a lump sum, but can also be in the form of weekly or monthly payments. Depending on the terms of the contract, it may be possible to defer some of the severance pay payments to reduce the tax impact.

It is also important to note that severance pay is typically only provided for employees being laid off involuntarily, not those resigning voluntarily. The exception to this is if an employee is being terminated in exchange for the signing of a release.

Employers can benefit from offering define severance pay because it improves morale and keeps workers more loyal to the company. Additionally, it can reduce the negative impact of mass layoffs if the company has to follow rules under the Worker Adjustment and Retraining Notification (WARN) Act. It is also possible that the severance package may include health insurance and other perks that would otherwise be unaffordable for the terminated employee. If you are considering leaving your job and want to understand the potential severance pay you could be entitled to, it’s important to speak with a New York severance payout lawyer. Contact Ottinger today to schedule a consultation.